Bloom, a blockchain solution that allows users to benefit from identity security and take part in an inclusive credit system, announced a collaboration with American Express Middle East to help drive fintech innovation as part of American Express Middle East’s ACCELERATE ME program. A blockchain solution for secure identity and credit scoring, Bloom has issued more than 12,000 BloomIDs over the past year and released an app for iOS. For institutions, the benefits are numerous: by decentralizing credit scoring, Bloom reduces the risk of identity theft, and minimizes costs associated with customer onboarding, compliance and fraud prevention.

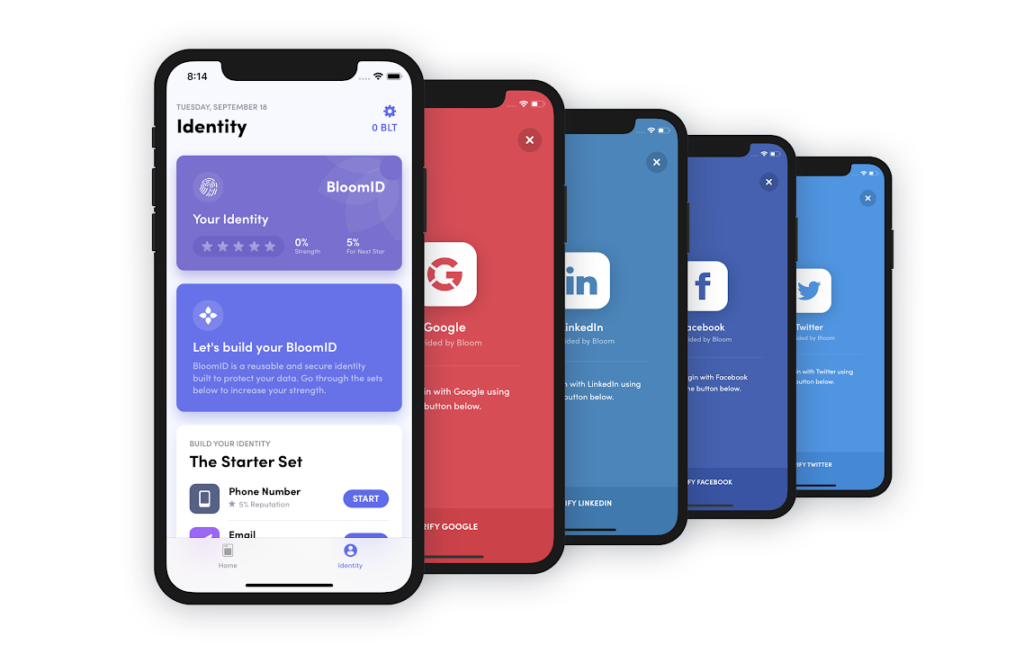

BloomID allows users who value their privacy or who are relocating across borders to create a secure identity that is vouched for by independent third parties, while BloomScore indicates a user’s likelihood to maintain financial obligations such as debt repayment. Its third segment, BloomIQ, tracks a user’s debt and stores that encrypted information on IPFS, a P2P distributed file system.

Building a modern global credit infrastructure which will be more secure, transparent and equitable for all, Bloom offers solutions to cross-border credit scoring and identity fraud. The company is at the forefront of financial inclusion through expanding credit globally to new individuals and improving scoring methodology.

ACCELERATE ME, launched by the Middle Eastern arm of American Express (AMEX) in Bahrain in collaboration with Nest in October 2018, is focused on helping promising startups and SMEs to expedite their growth trajectory and establish themselves in the global arena by offering innovative products and services with an impact.

Related: Award-winning tech startup Geltor raises $18.2 million in Series A funding